- Federal & State Legislation

- Health Insurance Portability & Accountability Act of 1996

- Tax Qualified & Non-Tax Qualified Policies

- Federal Tax Legislation

- State Tax Legislation

In this Web site we have addressed the problem that long-term care poses to our country, families, and individuals. The federal government has recognized these challenges and passed legislation standardizing long-term care insurance and offering tax-incentives on tax-qualified policies. This section will help you understand current legislation and how it affects long-term care insurance. The Health Insurance Portability and Accountability Act of 1996 (HIPAA) includes provisions for favorable tax treatment of qualified long-term care (LTC) insurance contracts. Some of these provisions affect premiums, benefits, employer contributions, and medical expense deductions, among others. Important Note: The information in this section is only intended as a general overview and is not intended to provide tax advice. There may have been changes in the tax law that may affect the information in this section. Please consult a tax-advisor for specific tax advice.

The Health Insurance Portability & Accountability Act (HIPAA) of 1996 (also known as the Kennedy-Kassebaum Bill), successfully addressed three items that affect long-term care insurance. These included the following:

1) Tightening up Medicaid eligibility requirements

2) Setting state standards on long-term care insurance

3) Offering tax incentives for those persons who purchased long-term care insurance

HIPAA designated two types of long-term care insurance policies: tax-qualified (TQ) and non-tax qualified policies (NTQ). The tax-qualified policies are the ones that adhere to HIPAA criteria that standardized long-term care policies and offer tax incentives. The differences of the two are described in detail in the TQ vs. NTQ section.

Long-term care insurance policies that were purchased before January 1, 1997 (when HIPAA was implemented) were grand fathered in and are considered tax-qualified (TQ) for federal purposes. They will remain tax-qualified if there are no material changes made to them.

This section addresses the main differences between the tax qualified (TQ) and the non-tax qualified policies. Which one is right for you? You can only make this decision after you look at both of your options.

Because tax qualified policies are now considered the same as accident and health policies, they may be eligible for tax deductions. They must also adhere to the standards set forth by HIPAA. Non-tax qualified policies are currently not eligible for any tax deductions and they do not have to meet all of the standards that HIPAA requires. Below we will examine the differences in benefit triggers, tax deduction status, and the taxability of benefits.

Benefit Triggers

Tax Qualified Policies:

These policies are required to use the same criteria to qualify when benefits should be paid under a policy. Included in the benefit triggers for a TQ policy are the following:

- The insured is expected to be unable to perform (without “hands-on or stand-by” assistance) at least 2 of 5 or more activities of daily living (ADLs). The activities of daily living are: bathing, eating, dressing, toileting, transferring, and continence. (California requires all 6 ADLs to be used.)

- Cognitive Impairment: The insured is diagnosed with a severe cognitive impairment where it is determined they are a threat to themselves or others.

- 90-Day Certification: TQ policies require certification from a health care practitioner of expected need for care of at least 90 days. NTQ policies do not require this certification.

- If you do not initially get the 90-day certification and you end up needing care longer than 90 days, your health care practitioner can certify that happened and the insurance company will pay retroactively based on your elimination period.

- If you do not get the 90-day certification and only need care for say, twenty days, those days would not count towards your deductible.

Non-Tax Qualified Policies:

These policies have no standardized benefit triggers. Therefore, the carrier can determine how liberal or strict they want their benefit triggers to be. Non-Tax Qualified benefit triggers can include medical necessity as a benefit trigger, and can require that the policyholder only needs help with one activity of daily living.

Tax Deduction Status

Tax Qualified Policies:

The premiums paid for these policies are eligible for both Federal and State tax deductions. These are discussed in detail in the Federal and State section.

Non-Tax Qualified Policies:

The premiums paid for these policies currently do not receive any tax deductions.

Taxability of Benefits

Form 1099-LTC:

All carriers are required to issue Form 1099-LTC to all beneficiaries when benefits are paid from either a TQ or NTQ policy. Benefits received from a TQ policy are income tax free, but there is no mention or decision relative to the taxation of benefits received from a non-tax qualified policy.

Per diem benefits received on a TQ policy are tax free up to $230 for the year 2004. If you receive per diem benefits above $230, they may be taxed as income, unless your actual long-term care expenses were also above $230.

As noted in the other sections, the tax deductions that are listed in this section only apply to Tax-Qualified policies.

Individual

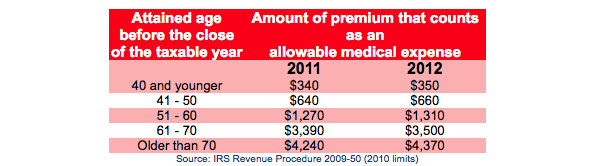

Premium payments to purchase qualified long-term care insurance by an individual – for yourself, your spouse, and your tax dependents (e.g. your children or dependent parents) are now included as a personal medical expenses if you itemize your taxes [IRC Sec. 213(a)]. Medical expenses in excess of 7 ½% of your adjusted gross income are tax deductible. This means that a portion of your long-term care insurance premium will help you reach the 7 ½% and may even help you to exceed that threshold to receive a tax deduction. Below is a table of the amount of premiums qualifying as medical expenses for the 2009 and 2010 tax years. This is often referred to as the eligible long-term care premium. These increase each year based on the Medical Consumer Price Index.

Self-Employed

Qualified long-term care insurance premiums may also be treated like health insurance for the self-employed tax deduction. Self-employed individuals may deduct 100% of the eligible long-term care premium shown above. The definition of self-employed includes sole proprietorships, partnerships, “greater than 2% shareholders” of S-corporations, or Limited Liability Corporations. Example: Bob, age 61, owns his own consulting firm. His long-term care insurance premium is $1,750 per year. Based on the chart listed under the INDIVIDUAL section, he is eligible to deduct 100% of up to $$3,290. Therefore, he can deduct the entire $1,750.

C-Corporations

Premium payments are fully (100%) deductible as a reasonable and necessary business expense- similar to traditional health and accident insurance premiums [IRC Sec. 213(d)1]. This can apply to the owners, their spouses and dependents, and all employees.

Employer-paid long-term care insurance is excludable from the employee’s gross income and the benefits received are tax-free.

Partnerships, S-Corporations and Limited Liability Corporations (LLC)

Premium payments purchased for a partner or owner (2%+ shareholder) are subject to the same rules mentioned above for self-employed.

Premium payments for non-partner/non-owner or less than 2% shareholder-employeeare 100% deductible as a reasonable and necessary business expense — similar to traditional health and accident insurance premiums.

Employer-paid long-term care insurance is excludable from the employee’s gross income and the benefits received are tax-free.

Important Note: The information in this section is only intended as a general overview and is not intended to provide tax advice. There may have been changes in the tax law that may affect the information in this section. Please consult a tax-advisor for specific tax advice.

Save

Save

State Tax Incentives for Long-term Care Insurance

| STATE | CREDIT OR DEDUCTION | SUMMARY |

| Alabama | Deduction | A deduction is allowed for the amount of premiums paid pursuant to a qualifying insurance contract for qualified long-term care coverage. |

| Arkansas | Deduction | “Eligible” LTCI premiums may be a deductible as medical expenses when such premiums are paid towards “qualified” LTCI is set forth in IRC Sec. 7702B(b)(1). This deduction for unreimbursed medical expenses exceed 7.5% of the taxpayer’s AGI. (e.g same deduction allowed federally) |

| California | Deduction | Permits the same tax deduction as is allowed for federal income tax purposes for premiums paid for the purchase of qualified LTCI. |

| Colorado | Credit | State income tgax credit equal to the lesser of 25% of premiums paid for an LTCI plicy or $150.00 per policy. Individuals who qualify for the credit are those with federal taxable income less than $50,000 ($100,000 joint filers claiming a credit for 2 policies). A LTCI policy must meet Colorado’s definition of long-term care. |

| District of Columbia | Deduction | A deduction in the amount an indivdual pays annually in premiums paid for LTCI is permitted from gross income, provided that the deduction not exceed $500,000 per year, per individual, whether the individual files individually or jointly. An LTCI policy must meet the District of Columbia’s definition of long-term care. |

| Hawaii | Deduction | An individual state tax deduction is allowed for LTCI premiums. This deduction is limited in the same manner as the deduction on the federal level, and is also only availavle to the extent that all medical expenses, including long-term care, exceed 7.5% of Hawaii Adjusted Gross Income instead of the Federal Adjusted Gross Income. |

| Idaho | Deduction | Premiums paid during the taxable year , by a taxpayer for LTCI, which LTCI is to be for the benefit of the taxspayer, a dependent of the taxpayer or an employee of the taxpayer, may be deducted from taxable income to the extent that the premium is not otherwise deducted or accounted for by the taxpeyer for Idaho income tax purposes. The deduction may be taken for a federally tax-qualified LTCI policy meeting Idaho’s definition of LTCI. |

| Indiana | Deduction | For tax years beginning on or after January 1, 2000, an individual taxpayer is permitted to deduct an amount equal to the eligible portion of premiums paid during the taxable year by the taxpayer for a qualified long-term care policy (as defined in the Indiana Code, for the taxpayer, the taxpayer’s spouse, or both FOR QUALIFIED PARTNERSHIP POLICIES ONLY. [Ind. Code Secs. 6-3-1-3.5 and 12-15-39.6.5 (Aualified Long-Term Care Policy) |

| Iowa | Deduction | Permits tax deduction from net income for premiums paid for LTCI coverage for nursing home coverage to the same extent allowable under federal law and to the extent not otherwise deducted in computing Adjusted Gross Income. |

| Kansas | Deduction | HB 2545 permits tax deduction from net income for premiums paid for qualified LTCI for up to $500. The total deduction amount will increaseby $100 for each tax year until December 31, 2009; a deduction not exceeding $1,000 of the premium costs for all taxable years commencing after December 31,2009. |

| Kentucky | Exclusion | A taxpayer may exclude from Kentucky Adjusted Gross Income any amounts paid for long-term care insurance as defined in the Kentucky code. [Ky. Rev. Stats. Sec. 141.010(10)(m) Reg. 304.14-600 & 610] |

| Maine | Deduction | A deduction is allowed for an amount equal to the total premium spent for insurance policies for long-term care that have been certified by the Superintendent of Insurance as complying with Title 24-A, Chapter 68. For tax years beginning on or after 1/1/04, a taxpayer may tax a state income tax deduction an amount equal to the total premiums spent for LTC insurance, as long as the amount subtracted is reduced by any amount claimed as a deduction for federal income tax purposes. [36 Me. Rev. Stat. Sec. 5122] Amended 5/11/04 [Title 36, Part 8, Chapter 805, Sec. 5122 (1989)] |

| Maine | Credit | For employers, a credit is allowed against the tax imposed for each taxable year equal to the lowest of the following: (A) $5,000; (B) 20% of the costs incurred by the taxpayer in providing long-term care policy coverage as part of the benefit package; or, (C) $100 for each employee covered by an employer provided long-term care policy. [Title 36, Part 4, Section 2525, Chapter 357 (1996)] |

| Maryland | Credit | To qualify for the credit, the insured must be all of tghe follwoing: An employer may claim a credit equal to 5% of the costs incurred during the taxsable year to provide LTCI as part of an employee benefit plan. The credit may not exceed the lesser of of $5,000 or $100 for each employee covered by the LTCI. The credit may only be applied against one tax if the employer is subject to one tax against which the credit is allowed. If the credit is more than the tax liability, the uinused credit may be carried forward for the next five tax years |

| Minnesota | Credit | For tax years beginning on or after January 1, 1999 a credit is allowed for long-term care insurance premiums during the taxable year equal to (1) 25% of premiums paid to the extent not deducted in determining federal taxable income; or, (2) $100. Maximum allowable credit per year is $200 for couples filing jointly and $100 for all other filers. Any unused tax credit may not be carried forward to future tax years. No credit is allowed if the taxpayer deducted the premium amounts when net taxable income was calculated or the premiums were excluded from net taxable income. |

| Mississippi | Credit | As of January 1, 2007, a taxpayer is allowed a credit against the income taxes imposed under this chapter in an amount equal to 25% of the premium costs paid during the taxable year for a qualified long-term care insurance policy as defined in Section 7702B of the Internal Revenue Code that offers coverage to either the individual, the individual’s spouse, the individual’s parent or parent-in-law, or the individual’s dependent as defined in Section 152 of the Internal Revenue Code. No taxpayer is entitled to the credit with respect to the same expended amounts for qualified long-term care insurance which are claimed by another taxpayer. The credit allowed by this section shall not exceed $500 or the taxpayer’s income tax liability, whichever is less, for each qualified long-term care insurance policy. Any unused tax credit shall not be allowed to be carried forward to apply to the taxpayer’s succeeding year’s tax liability. No credit shall be allowed under this section with respect to any premium for qualified long0term care insurance either deducted or subtracted by the taxpayer in arriving at his net taxable income under this section or with respect to any premiums for qualified long-term care insurance which were excluded from his net taxable income. |

| Missouri | Deduction | Beginning January 1, 2007, this bill authorizes 100% of the amount paid for non reimbursed qualified long-term care insurance premiums to be deducted from a taxpayer’s Missouri taxable income to the extent the amount is not already included in the taxpayer’s itemized deductions. SB 577 (SECTION 135.096] Formerly, a deduction was allowed for a resident from state taxable income for an amount equal to fifty percent of all non reimbursed amounts paid by an individual for qualified long-term care insurance premiums to the extent such amounts are not included in the individual’s itemized deductions for all taxable years beginning after December 31, 1999. [Section 8 of R.S. MO 334660 (1999)] [Mo. Rev Sat. SEc. 135.096] Secs. 376.951-376.958 of Missouri Long-Term Care Insurance Act.] |

| Montana | Deduction | A deduction is allowed for all premium payments made directly by the taxpayer for long-term care insurance policies or certificates that provide coverage primarily for any qualified long-term care services as defined in 26 U.S.C. 7702B(c) beginning after 12/31/94 or of the taxpayer’s parents, grandparents, or both for taxpayers beginning after 12/31/96. [Chapter 111, (1997)] |

| Montana | Credit | A limited credit is available for expense of caring for certain elderly family members (which includes premiums paid for long-term care insurance coverage.) The amount of credit is determined based on the taxpayer’s adjusted gross income and cannot exceed $5,000 per qualifying family member in a taxable year ($10,000 for two or more family members). [Mont. Code Sec. 15-30-128] |

| Nebraska | Deduction | Participants may deduct up to $1,000 ($2,000 filing jointly) from their federal adjusted gross income for Nebraska state income tax purposes by depositing an equal amount into a designated Long-Term Care Savings Plan account at a participating financial institution. (LB 965 – 1/1/06) LB 305 approved may 30, 2007 for anyone turning 50 in 2007, benefits Nebraskans by strengthening Nebraska’s Long Term Care Savings Plan by 1) Allowing a participant to pay a long-term care insurance policy premium for another person for whom the taxpayer has an insurable interest; 2) Allowing a person who turned 50 during the taxable year to make payments for long-term care insurance premiums during the taxable year. (These Legislative Bills amend Section 77-6102 of Nebraska State Law). |

| New Jersey | Deduction | Allows a deduction for medical expenses (including long-term care insurance premiums), only to the extent such expenses exceed 2% of taxpayer’s gross income. [N.J. Stat. Sec. 54A:3-3] |

| New Mexico | Deduction | Permits deduction for premium paid for qualified long-term care insurance contract defined in Internal Revenue Code section 7702(B), as part of unreimbursed or uncompensated medical care expenses. Total medical expense deduction is limited, based on income level. [N.M. Stat. Ann. sec. 7-2-35] |

| New York | Credit | A credit is allowed equal to 20% of the premium paid during the taxable year for long-term care insurance approved by the Superintendent of Insurance provided policy qualifies for such credit pursuant to Section 1117. If the amount of credit allowable under this subsection for any taxable year shall exceed the taxpayer’s tax for such year, the excess may be carried over to the following year or years and may be deducted from the taxpayer’s tax fro such year or years and applies to taxable years beginning on or after January 1, 2004. [Sec. 210, subdivision 25-0-1 Chapter 58 (2004)] [NY Tax Law SEc. 606(aa)] |

| North Dakota | Credit | A credit is allowed to be applied against an individual’s tax liability in the amount of 25% of any premiums paid by the taxpayer for long-term care insurance coverage for the taxpayer or the taxpayer’s spouse, parent, step-parent or child. The credit may not exceed $100 in any taxable year. [Title 57, Chapter 57-38 (1997)] |

| Ohio | Deduction | A deduction is allowed for individual policy premiums paid for qualified long-term care insurance effective for taxable years beginning January 1, 1999. Generally allows a deduction for the amount paid for qualified long-term care insurance for the taxpayer, his spouse, and dependents [OH REV. STAT. Section 5747.01 (1999)] |

| Oklahoma | Deduction | Permits the same tax deduction as is allowed for federal income tax purposes. [68 Okl. Stat Sec. 2353] |

| Oregon | Credit | A credit is allowed for amounts paid or incurred for long-term care insurance by an individual on behalf of individual, dependents or parents and for amounts paid or incurred by employer on behalf of employees. Limits credit to lesser of 15% of premiums or $500. In order for the credit to be available the policy must be issued after January 1, 2000. The credit is not refundable and cannot be carried forward. [Or. Rev. Stat Sec. 315.610 Sec 743.652 (Definition for Secs. 743.650 – 743.656)] |

| Utah | Deduction | A deduction is allowed from federal taxable income of a resident or nonresident individual for tax years beginning on or after January 1, 2000, of any amounts paid for premiums on long-term care insurance policies to the extent the amounts paid were not deducted under Section 213 of the Internal Revenue Code in determining federal taxable income. This deduction is for all premiums paid for long-term care insurance as defined under the Utah Code. [Chapter 60, ‘ 59-10-114(1999)][Utah Code Sec. 59-10-114(2)(K) Sec. 31A-1-301] |

| Virginia | Deduction | If the tax-qualified policy was purchased after January 1, 2006, an individual may be eligible for a tax credit equal to 15% of the total premiums paid in the year for the first 12 months of coverage. Certain limitations apply. Other credits maybe available for previously purchased policies. |

| West Virginia | Deduction | A deduction is allowed for taxable years beginning on or after the first day of January, 2000, for any payment during the taxable year for premiums for a long-term care insurance policy that offers coverage to either the taxpayer, spouse, parent, or dependent, only to the extent the amount is not allowable as a deduction when arriving at the taxpayer’s adjusted gross income. Premiums for long-term care insurance are those premiums as they defined in the West Virginia Code [Article 21 ‘ 11-21-12C, Chapter 11 (2000)] [W. Va Code Secs. 11-21-12c & 33-15A4-] |

| Wisconsin | Deduction | Allows a person to subtract from federal adjusted gross income a portion of the amount paid for long-term care insurance policy for taxpayer and his spouse when computing Wisconsin taxable income beginning on or after January 1, 1998. [WIS. STAT. ‘ 71.05(6)(b)26(1997)] |

| Source: American Council of Life Insurers (updated 8-17-07) | ||